How To Find Perfect HERO Trades

There are over 5,000 listed companies — and tracking all of them is impossible.

Even big research teams can’t do it properly.

And having too many choices isn’t always good. More choices usually lead to more confusion.

You end up skimming through companies without going deep — and that hurts the quality of your decisions.

As a retail trader, your goal isn’t to know everything. Your goal is to go deep in a few companies you understand well.

It’s not about quantity — it’s about depth.

That’s why you need a filtering process. A system to narrow down your universe from 5,000 companies to a focused list you can actually track.

You want to track enough stocks to find sufficient number of trades — but not so many that it overwhelms you.

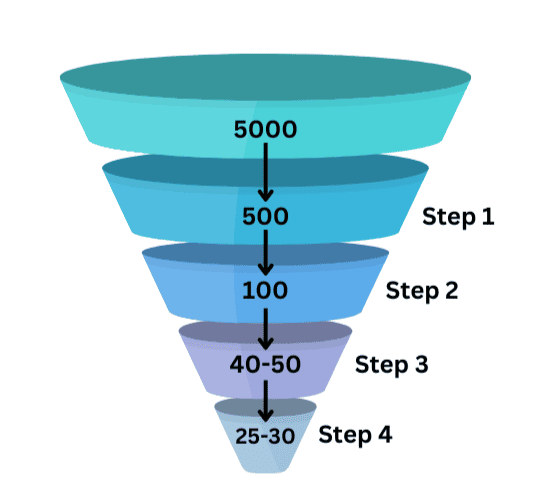

In this article, you’ll learn how to narrow down 5,000 stocks to just 25–30 high-potential trades that perfectly fit the HERO Strategy.

These are the trades with the best reward-to-risk setups — making your trading more focused and less stressful.

Let’s get started.

Step 1: Define Your Trading Universe

Instead of trying to track thousands of stocks, focus on a manageable list.

A great starting point is the Nifty 500 — a collection of India’s top 500 companies.

These are companies with strong management, decent fundamentals, and high liquidity — so you’re not dealing with shady businesses or getting stuck in illiquid stocks.

The Nifty 500 is divided into:

- Top 100 – Large caps

- Next 150 – Mid caps

- Next 250 – Small caps

By sticking to these 500 companies, you get exposure to the entire market — large to small — without overwhelming yourself.

There are always enough good trades within this universe.

You can download the full list of Nifty 500 companies from the NSE website.

By narrowing your focus to high-quality stocks, you don’t have to stare at charts all day.

Even if you have a full-time job or a business, a few hours on the weekend are enough to find great trades and make money from the market.

You don’t need to compromise with your job or business — you just need to focus your energy in the right direction.

Step 2: Use Relative Strength

Now that you’ve narrowed your trading universe to 500 companies, the next step is to find the strongest ones.

The first part of the HERO strategy is High earnings growth (H) — but predicting future growth takes time.

Reading a company’s conference call transcript alone can take an hour.

Doing that for 500 companies?

That’s 500 hours — not realistic.

And if you don’t know a company’s future growth, you can’t calculate whether the stock is cheap or expensive — so you can’t move to the E part of HERO either.

That’s why you start with Relative Strength (R).

Relative strength helps you quickly identify the stocks that are outperforming the market.

When the market drops, around 80% of stocks fall — but the strongest 20% hold up.

Sometimes it’s 15%, sometimes 25% — but 20% is a good rule of thumb.

By applying this filter, you can reduce your list of 500 stocks down to 100 relatively strong stocks.

Best part?

It takes just one hour to do — and you don’t need to do it daily.

Use it only when the market has dropped by 8–10% to see which stocks are showing strength.

Now you’re no longer tracking 500 names — you have a focused list of 100 high-potential stocks.

Step 3: High Earnings Growth

Now that you’ve filtered down to 100 strong stocks, it’s time to dive deeper and analyze their future growth.

Start with the stocks that are rising even when the market is falling.

If a stock goes up while everything else is going down, it’s a clear sign that big institutional investors expect strong future performance.

These are often your best chances to find high-growth opportunities.

This step will take the most time — because now you need to dig into the fundamentals.

Reading one company’s earnings conference call takes about an hour. For 100 companies, that’s 100 hours of work.

But here’s the good news — companies release earnings only once every quarter, so you don’t have to rush.

Even if you spend just a few hours on the weekend, you can make steady progress.

You don’t need to analyze all 100 companies at once. Just stay consistent, and over time, you’ll get the job done.

And if that still feels overwhelming, don’t worry.

I read dozens of conference call transcripts every week.

And when I find a company with serious growth potential — I don’t keep it to myself.

I share it with you in the HERO Newsletter.

Join the newsletter and discover which companies are expected to grow in the coming years.

Once you finish analyzing the 100 companies, you’ll likely find 40–50 stocks with expected earnings growth of 20–25% or more.

Some may even be set to grow 40–50% or higher.

At this point, you now have a list of companies that meet both:

- H – High Earnings Growth

- R – Relative Strength

You’re getting closer to finding your perfect HERO trades.

Step 4: Expensive or Cheap?

Now that you have a list of 40–50 companies with strong future growth, most of the hard work is done.

The next step is to check valuations — how cheap or expensive the stocks are.

If a stock is overpriced, discard it. Keep only the ones with cheap or reasonable valuations.

After this step, you’ll be left with 25–30 high-potential companies that meet the three HERO criteria:

H – High earnings growth

E – Reasonable valuation

R – Relative strength

These are the stocks with the best reward-to-risk opportunities.

Focusing your energy on this short list will make your trading more disciplined, focused, and profitable.

Now comes the final step — you wait.

Keep these 25–30 stocks on your watchlist and watch for the perfect breakout.

When you see a chart pattern where demand is high and supply is almost zero, that’s your entry point. That’s your HERO trade.

By going through each step one by one, you filter out the noise and uncover the strongest trade setups in the market.

How Many Stocks Should You Own?

Every person has a different risk-taking capacity — so there’s no one-size-fits-all portfolio.

You want enough diversification so that one losing trade doesn’t hurt you, but you also want enough concentration so that one great trade actually matters.

If a stock doubles and it’s just 2% of your portfolio, your portfolio only grows by 2%.

That’s not how you make meaningful returns.

A good starting point is to hold 10 stocks, with 10% allocation in each.

Then, observe.

See which companies are doing well — and which ones are not performing as expected.

If a stock isn’t behaving according to your expectations, reduce its allocation and shift that capital to the ones that are performing well.

Over time, you want larger allocation in stocks with the highest potential.

Equal allocation may feel safe, but it won’t give you asymmetric returns.

The number of stocks in your portfolio should also depend on your risk appetite:

- If you’re a high-risk taker, you can hold just 5 high-conviction stocks.

This concentrated portfolio gives you the highest potential return — but it can also cause sleepless nights if things go wrong. - If you prefer stability, hold up to 15 stocks.

A diversified portfolio will reduce volatility — but it will also cap your upside.

As you understand your risk tolerance, adjust the number of stocks to your comfort — anywhere between 5 and 15.

Don’t go beyond 15 stocks as a retail trader. Managing more than that becomes difficult.

If you have too many stocks, it gets hard to track performance and stay updated on each one.

Start with 10.

Then adapt — until you find the balance that works for you.

Wrong Way To Filter Stocks

While it’s good to know what you should do, it’s just as important to know what you should not do.

There’s a wrong way to filter stocks — and if you follow it, it will fill your life with stress, confusion, and sleepless nights.

I know this because I’ve lived it.

I used to follow this path.

It made my life miserable — full of anxiety, constant FOMO, and no peace of mind.

Most traders make the same mistake:

They dump hundreds of stocks into their watchlist using random screeners like “52-week high,” “high volume,” or “above 200-day moving average.”

But that only leads to one thing — chaos.

When you’re tracking hundreds of stocks, you don’t have the time or clarity to analyze them properly.

You’re always worried — which one will break out? which one should I buy? what if I miss it?

And here’s the real problem: you’re always late.

You wait for a breakout, and only then you start analyzing the company.

By the time you make a decision, the stock is already gone — and now you’re chasing. That’s how FOMO takes over your trading.

But that’s not how serious, disciplined traders operate.

Ideally, you want to have the stock on your watchlist before it breaks out. Not after.

And that’s exactly what the HERO filtering process gives you.

By following the steps I’ve shown you, you’ll already have the best stocks on your watchlist — positioned perfectly, just before the breakout happens.

Like a tiger hiding in the bushes, ready to strike.

When the opportunity comes, you act with confidence.

No panic. No doubt. No chasing.

While others chase, you move with grace.

That’s the edge HERO gives you — and that’s the edge you need to trade with conviction.

Define Your Own Trading Universe

I recommend the Nifty 500 to you because it keeps things simple and safe for new traders.

These companies have solid management and clean governance, so you avoid shady businesses and hidden risks.

As you gain experience with the HERO strategy, you can and you should expand your trading universe.

If you’re after explosive growth and exceptional returns, look at micro-cap stocks. Some can grow earnings by 100% a year — high risk, high reward.

You can add the Nifty Microcap 250 to your trading universe, but only if you’re ready to do deeper research and handle the volatility.

The upside can be massive, but so can the drawdowns.

For now, stick to Nifty 500.

Once you’re confident, expand your trading universe— but only with caution and clarity.

🟠 Still Have a Doubt? Let’s Solve It Together.

Learning is powerful — but asking the right questions is what turns knowledge into results.

Most traders stay stuck because they never ask. Don’t be one of them.

Ask me directly here — and I’ll personally help you move forward.

Keep Learning

Next Lesson: Five Steps