The Art Of Selling

Most traders focus only on one thing—buying.

They spend hours searching for the perfect stock, the perfect entry, the perfect breakout.

“Is this the right time to buy?” they ask.

But very few ask the real question: “When should I sell?”

Buying is just half the game.

Selling is where the money is made—or lost.

Without a clear exit plan, even the best trade can turn into a disaster.

Think of Abhimanyu from the Mahabharata.

He knew how to enter the Chakravyuh… but didn’t know how to exit.

He fought bravely—but got trapped and died.

Many traders suffer the same fate. They know how to enter a stock—but don’t know how to get out.

They ride the stock up… profits grow… confidence rises.

Then the trend reverses.

The stock starts falling.

At first, they ignore it. “Just a small dip,” they think.

But the dip gets deeper.

Soon, all their gains are gone.

Worse—now they’re in a loss.

By the time they finally sell, the stock is down 50-70%.

This is why exit strategy matters.

Most HERO stocks fall 50-70% after their big run is over. If you don’t exit on time—you give it all back.

In this chapter, you’ll learn when to sell, how to lock in profits, and how to get out before it’s too late.

But before we dive in—

Let’s talk about the one emotion that destroys more traders than anything else: regret.

Regret Of Selling

No trader—no matter how skilled—can sell at the top.

It’s just not possible.

Even the best in the world either sell too early or too late.

And that’s where regret creeps in.

If you sell too early and the stock keeps rising, you feel frustrated:

“Why did I sell? I could’ve made more!”

But if you hold on—and the stock crashes— That regret hurts even more: “Why didn’t I take my profits when I had the chance?”

Watching a winning trade turn into a loss is one of the worst feelings in trading.

Either you’ll regret selling too early, or you’ll regret selling too late. In either case, regret is guaranteed.

This is what makes selling so stressful.

It puts you in a constant loop of second-guessing yourself.

But here’s the truth: The problem isn’t whether you sell early or late. The real problem is trying to sell at the top.

The solution?

Stop Chasing Perfection.

Use Scaling out technique.

Let’s say you’re up 150% on a stock.

You feel it’s expensive and are thinking of selling.

But then your mind says: “What if it goes even higher?”

Here’s the smart move:

Sell half.

If the stock goes up, you say, “Thank God I’m still holding.”

If it goes down, you say, “Glad I booked some profits.”

Either way, you win.

No pressure. No emotional rollercoaster.

Just calm, rational trading.

Now let’s get to the part every trader needs to master — knowing exactly when to sell.

When To Sell

When you buy a stock using the HERO strategy, you follow four key conditions:

1. Future Earnings Growth – The company must have strong earnings potential.

2. Fair or Cheap Price – The stock should not be overvalued.

3. Relative Strength – It must be outperforming the market.

4. Zero Supply – The chart must show a proper breakout setup.

You buy only when all four are met.

So, when should you sell?

When any one of these conditions breaks.

- If the chart setup weakens, it’s a sign to sell.

- If the stock becomes relatively weak compared to the market, it’s a sign to sell.

- If the stock becomes too expensive, lock in profits.

- If the fundamentals turn negative and you’re not sure about future earnings, exit without hesitation.

Let’s go through each of these in detail.

1. Exit Using Chart Patterns

Charts don’t just help you buy. They help you sell too.

When a stock enters an uptrend, you ride it. But when the trend changes — you exit.

Look for clear signs:

- Lower highs, lower lows

- High volume selling

- Failed breakout

These signs mean the uptrend is over.

Don’t wait. Don’t hope.

Once the trend weakens, risk goes up fast.

Exit early. Protect your profits.

The trend is your friend… until the end, when it bends.

Once the trend reverses its direction, it’s time to book your profit and move on.

The chart told you when to enter. It will tell you when to get out.

Trust it.

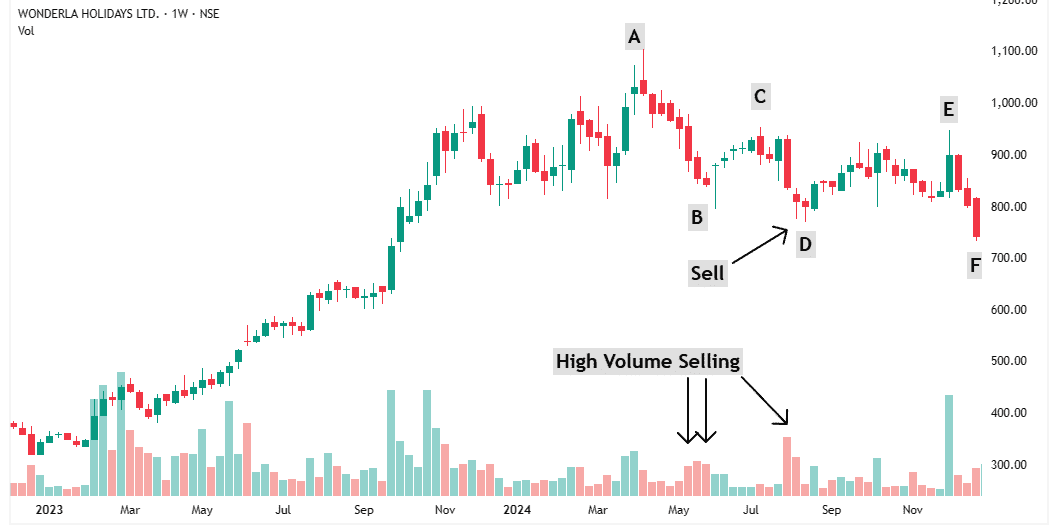

Example 1: Wonderla

Up to Point A, the stock was in a clear uptrend.

Then came a deep pullback to Point B — and selling volume increased.

That’s your first warning. Something’s not right.

The stock bounced to Point C but failed to make a new high. Then it started falling again.

It broke below Point D with heavy volume. That’s not retail panic — that’s institutions exiting.

At Point C, it made a lower high.

At Point D, a lower low.

The trend has officially reversed.

This is your exit signal. Sell and move on.

If you missed it, the market gave you one more chance at Point F.

Don’t ignore it — that was your final warning.

Don’t wait. Exit before it’s too late.

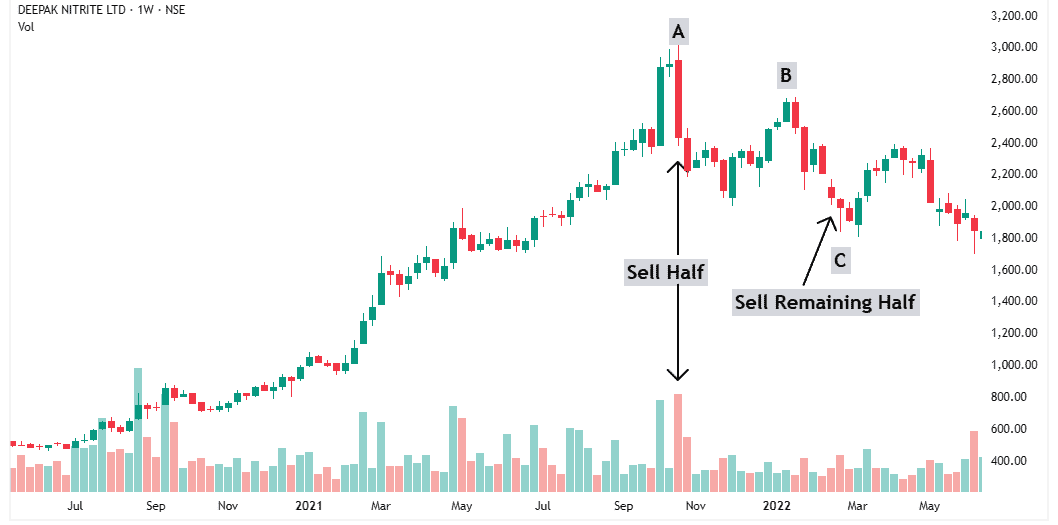

Example 2: Deepak Nitrite

At Point A, there was heavy institutional selling — just look at the volume.

The stock was still in an uptrend, so no need to exit completely.

But this is where you apply the scaling out technique.

Sell 50% of your position at Point A.

Wait for confirmation before selling the rest.

The stock then bounced to Point B but failed to make a new high.

That’s another warning — the trend is weakening.

At Point C, the stock made a lower high. Now it’s official — the trend has reversed.

Lower high at Point B, lower low at Point C — clear sign of a downtrend.

At Point C, sell the remaining 50% and exit fully.

This way, you lock in profits early and avoid regret later.

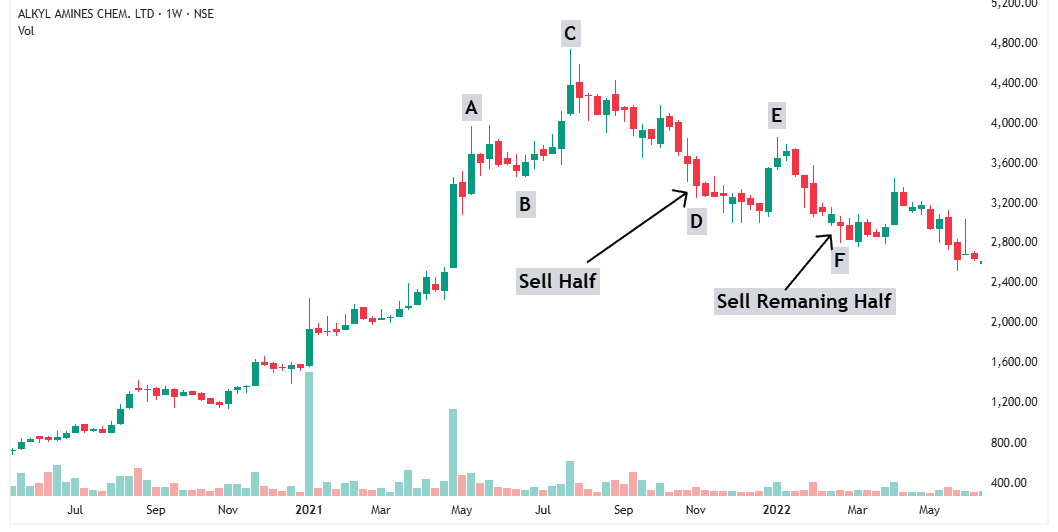

Example 3: Alkyl Amine

The stock was in an uptrend until Point A. It then made a higher low at Point B and a new high at Point C, which still confirmed the uptrend.

At Point C, there was no way to know if this was the top or if the stock would keep going up—it still looked strong.

Then, at Point D, the stock fell below the previous low at Point B.

This broke the uptrend, but since it hadn’t made a lower high yet, it wasn’t in a downtrend either.

At this point, the stock is in a range—neither going up nor down.

What should you do?

Sell half of your shares because the trend is no longer clear.

Now, the stock will either resume its uptrend or start a downtrend.

You need to wait and see.

At Point E, the stock makes a lower high (a sign of weakness).

At Point F, it makes a lower low—a signal that downtrend has started.

Now, it’s time to sell the rest of your shares.

Once the stock changes its trend, it usually crashes hard. You must exit before the real damage happens.

2. Exit Using Relative Strength

You bought a stock. It went up. All good.

But now, it has stalled. It’s just moving sideways.

Meanwhile, the market is still rising.

This is a warning.

Your stock is now relatively weak. It’s underperforming.

You might think, “It’s not falling. Maybe it’ll go up later.”

But here’s the truth: it’s only holding because the market is strong.

The moment the market stops going up, your stock will be the first to crash.

Don’t wait for that.

Exit early.

A weak stock today becomes a falling stock tomorrow.

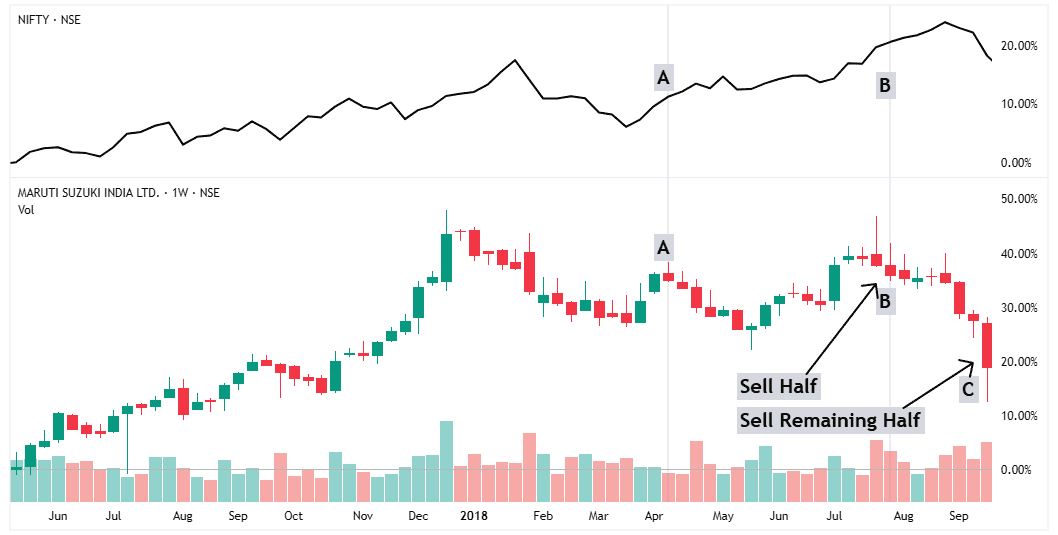

Example 4: Maruti

From Point A to Point B, Maruti moves sideways while the market keeps rising.

That’s your first warning.

The stock is losing relative strength. It’s not falling yet—but only because the market is strong.

At Point B, volume spikes. That’s not retail selling. That’s institutional selling.

What should you do?

Sell half. Raise cash. Wait.

Soon, the market stalls… and Maruti breaks support at Point C.

Now the downtrend begins.

That’s your final signal—exit completely.

Relative strength gives you an early warning. Don’t ignore it—act before the real fall starts.

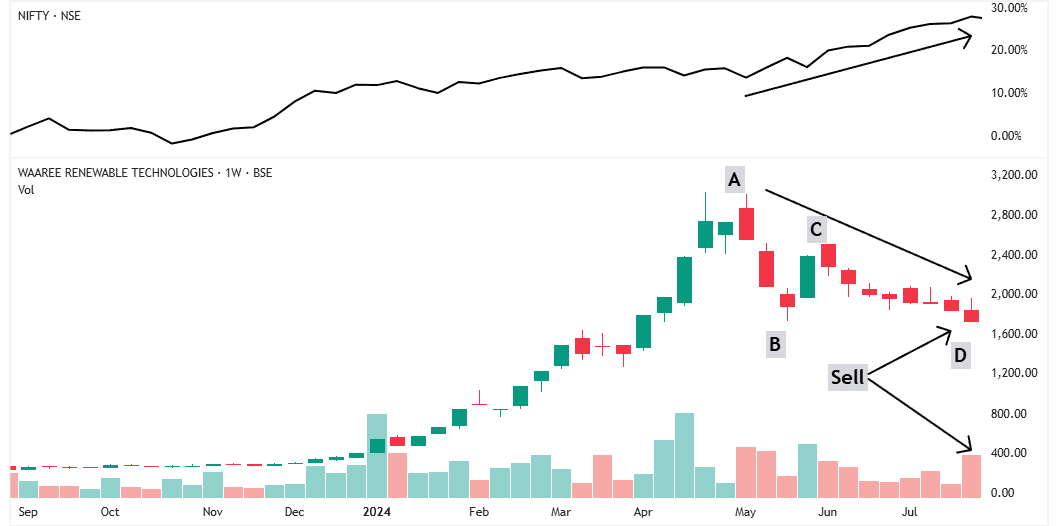

Example 5: Waaree Renewable

From Point A to B, the stock pulled back—nothing unusual. It was still in an uptrend.

Then it rose to Point C but started falling again… while the market kept going up.

That’s a warning. Your stock is now weaker than the market.

Time to reduce your position—sell some shares.

At Point D, it makes a new low with heavy volume.

Institutions are exiting. The trend has turned.

That’s your final signal—exit completely.

If you had watched relative strength closely, you’d have seen it underperforming before Point D.

That’s when I would start selling.

Once the trend breaks, I’m out. No questions asked.

3. Exit Using Valuations

Valuation matters—not just when buying, but also when selling.

High P/E stocks are risky. In a market downturn, they fall the most.

Why?

Because when investors panic, the P/E ratio shrinks fast, and the stock crashes.

Holding an overvalued stock is like sitting on a time bomb. Sooner or later, it blows up.

But here’s the tricky part: expensive stocks often keep rising before they fall.

If you sell just because it’s expensive, you might exit too early and miss more gains.

So, what’s the smart way to handle it?

Let’s break it down with an example.

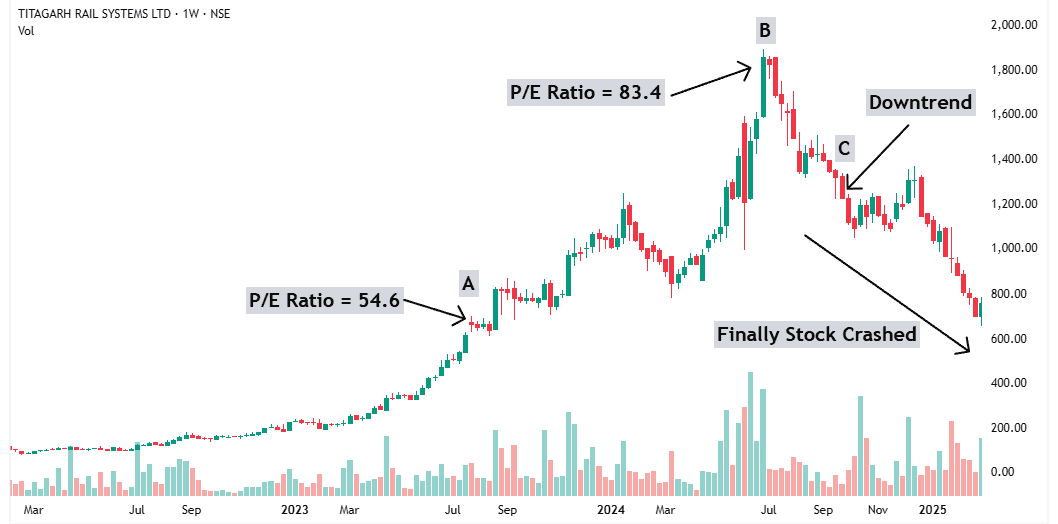

Example 6: Titagarh Rail Systems

Imagine you own Titagarh Rail, expected to double revenue in 3 years—about 26% annual growth.

At Point A, its P/E was 54.6. The PEG ratio was 2.1

That’s expensive.

If you had sold everything at Point A, you’d have missed out—because the stock tripled after that.

By Point B, the P/E jumped to 83.4. PEG became 3.2

An expensive stock became even more expensive.

That’s the trap—selling just on valuation.

Here’s the smarter way to play it:

- If a stock looks too expensive, sell half—not all.

- Wait and watch. If it keeps going up, you still ride the upside.

- When the trend finally breaks, sell the rest and exit.

In Titagarh’s case, if you sold half at Point A, you’d have booked some gains early.

Then, at Point C—when the trend reversed—you’d exit the rest.

This way, you lock profits early, stay in the game, and avoid regret.

Because let’s face it—you never know exactly when a trend will change.

That’s why combining valuation with technicals works best.

Sell half when it’s expensive.

Sell the rest when the trend breaks.

Simple. Safe. Smart.

Switch From Expensive To Cheap Stock

Let’s say you own a stock that’s done well—but now it’s expensive.

If you sell it too early, you might miss more gains.

So one smart option is: sell half now, and the rest when the trend breaks.

But here’s another option…

If you spot a new stock that ticks all the HERO boxes—and it’s still cheap—you can switch.

Sell the expensive stock. Buy the cheaper one.

Even if your old stock keeps going up, the new one will likely go up too. But now, you’re making money with lower risk.

Instead of riding an overheated stock, you’re compounding safely with a reasonably valued one.

So whenever you find a strong, cheap HERO stock—don’t hesitate.

Switch the capital from expensive to cheap stock. And stay ahead.

4. Sell When Your Earnings Expectations Change

You buy a stock because you expect strong earnings growth.

But what if that changes?

Maybe there’s a war, a recession, or some crisis—and now the company can’t deliver the profits you expected.

Doesn’t matter if you’re in profit or loss—just exit.

Holding a stock with weak future earnings is a risk you don’t need.

There’s another reason to sell—when you find a better opportunity.

Let’s say your stock is expected to grow earnings by 40% per year. But now you discover a new stock with 100% expected growth.

Your capital is limited. You can’t own everything.

So it’s simple—move your money to where the growth is faster and stronger.

Sell the old one. Buy the better one.

That’s how you make smarter use of your capital.

Beware Of The Strong Earnings Trap

Imagine you’re a big investor holding a large position. The stock has done well. You’re sitting on big paper profits.

But now, you see a problem—earnings will peak in the next 2–3 quarters.

What do you do?

Wait for the bad earnings?

No.

You sell before the fall—while earnings still look strong.

Why?

Because once weak earnings hit, everyone rushes to sell. And as a big investor, you won’t find enough buyers.

That’s why stock prices often peak before earnings do.

Big players exit early—when the future looks weak, not after the numbers confirm it.

Retail traders miss this.

They see strong earnings and think, “It’ll keep going up.”

But by then, the smart money is already out.

Now that you know this, don’t get trapped.

Stock prices peak before earnings peak. Always watch what big money is doing.

Let’s look at an example.

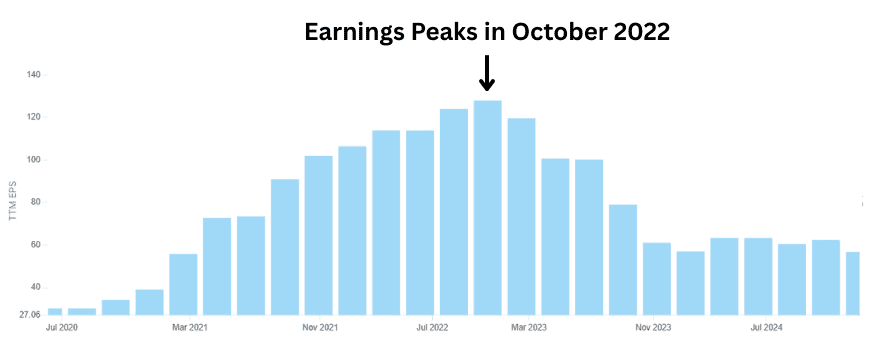

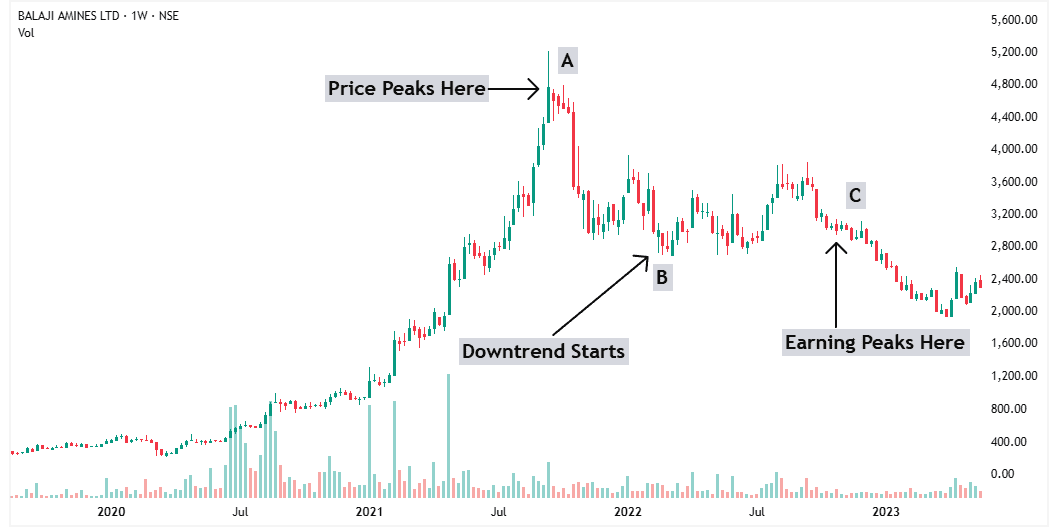

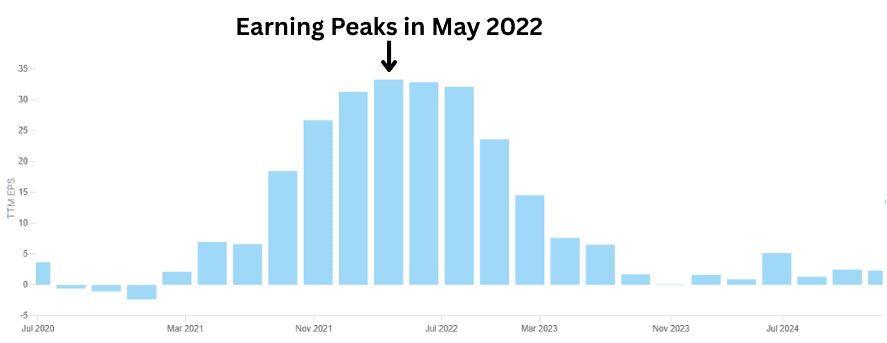

Example 7: Balaji Amines

Earnings kept growing until October 2022.

But guess what?

The stock price peaked way earlier—in September 2021.

That’s four quarters before earnings started falling.

Why?

Because big investors saw it coming.

They expected the slowdown and started selling early.

At Point B—three quarters before the earnings peak—the stock entered a downtrend.

That was your signal to sell.

The company was still posting strong profits. But the stock had already turned.

If you focused only on current earnings, you might’ve thought,

“It’s doing well. The price will bounce back.”

Big mistake.

Don’t get fooled by strong present earnings. It’s the future earnings that drive stock prices.

Once the trend breaks—exit.

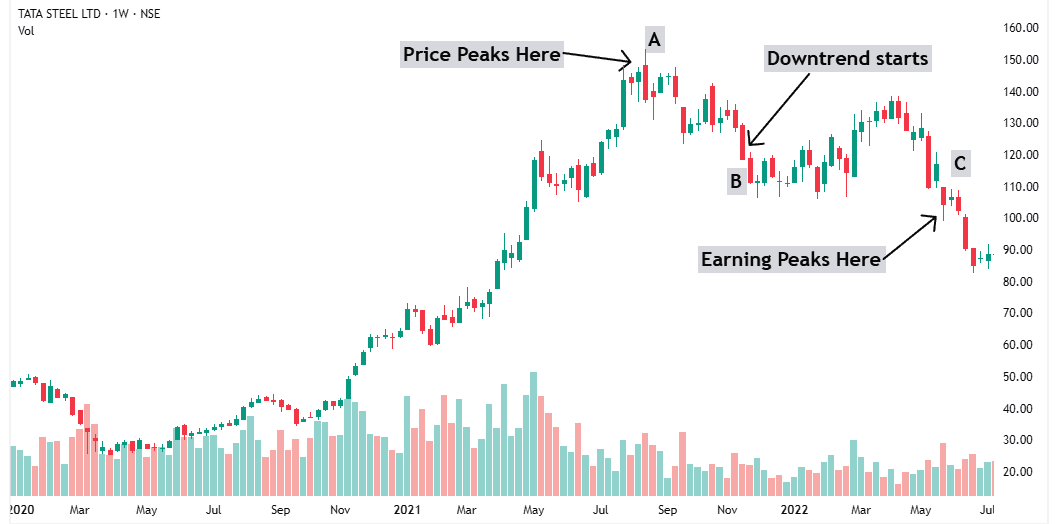

Example 8: Tata Steel

Earnings were rising until May 2022.

But the stock didn’t wait.

It peaked in August 2021—three quarters before earnings peaked.

Why?

Because institutional investors saw the slowdown coming and started selling early.

At Point B, the trend reversed. That was your cue to exit—even though profits still looked strong.

This is how the market works.

The stock market is a discounting machine. It moves before things happen—not after.

If earnings look great today but the future looks weak, the stock will fall early.

If a company is losing money now but the future looks better, the stock will rise early.

Stock prices reflect future expectations—not current reality.

That’s why you must watch the trend also, not just the earnings.

Conclusion

Most traders focus all their energy on finding the right stock to buy.

But they forget—money is made at the exit.

The difference between a good trade and a great one often comes down to one thing: Knowing when to get out.

The HERO strategy gives you four clear conditions for buying. You should also use them to know when to sell.

If even one condition breaks—it’s time to act.

Don’t wait for news.

Don’t wait for losses to pile up.

Don’t be like Abhimanyu—who knew how to enter, but not how to exit.

Learn to sell with confidence. Because protecting profits is just as important as making them.

🟠 Still Have a Doubt? Let’s Solve It Together.

Learning is powerful — but asking the right questions is what turns knowledge into results.

Most traders stay stuck because they never ask. Don’t be one of them.

Ask me directly here — and I’ll personally help you move forward.

Keep Learning

Next Lesson: The Pyramiding Technique